How It Works

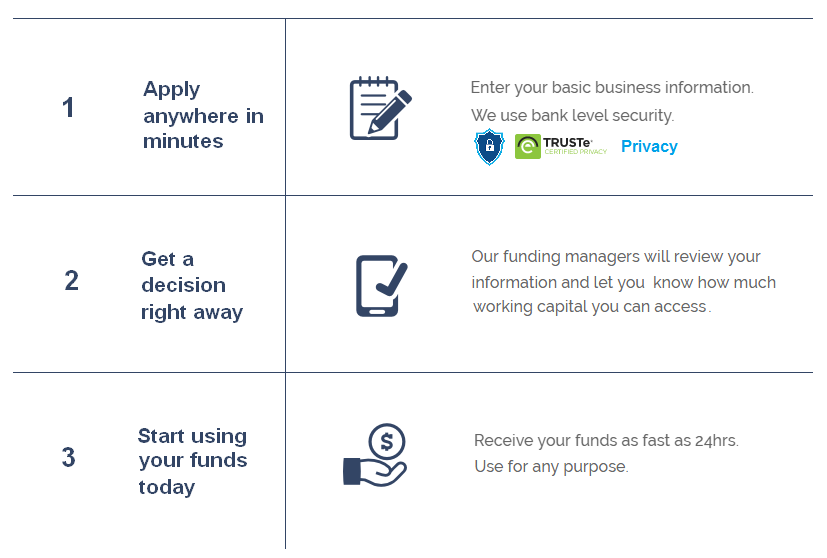

How The Process Works:

Why Choose Wall Street Funding

No Application Fee

Transparent

Approved in Less than 24 Hours

Secure

Bad Credit Ok

A+ Rating BBB

Apply Today, Grow Your Business Tomorrow

What Are Alternative Small Business Loans

Wall Street Funding wants to make sure you understand exactly the type of funding we provide. We advance capital against your future receivables. This is not a loan, rather a business advance. We are a private company that base our lending decisions on your business performance rather than your credit score. There is significantly less paper work involved and because we leverage technology we can underwrite and fund your business in as little as 24 hrs. We require No Collateral. We believe transparency through this process is paramount, and look to build a strong relationship with you and help get you to a point where you can access more traditional capital. A bank will always provide you with the best financing, but if you cannot secure capital from a traditional source, Wall Street Funding is a viable alternative.

The cost of capital and terms will vary depending on what our proprietary underwriting score dictates. Cost of capital will be between 7.9% and 45% with terms ranging from 4 months to 3 years. Our approval percentage is over 90%. A traditional bank loan will always provide the best terms so please check with your local banker first. Should you get declined, Wall Street Funding would welcome the opportunity to work with you.

Small Business Loans that Fit Your Business.

Questions? Call 877-851-3880

Testimonials

Over 10,000 businesses have received funding from Wall Funding.

Wall Street Funding is the best, I’ve had existing business for years, and this service sells itself.

JohnI was happy to see how easy it is! If I ever have a question the service is top-notch.

MariaQuick, reliable, and responsive. Wall Street Funding helped me open two new locations in days.

Stephanie